You Can't Win a Race by Going Backwards

/The Novel Corona Virus (COVID-19) has hammered economies around the world, leaving a huge number of otherwise healthy businesses shuttered due to social distancing measures. The government response has been swift, with numerous forms of support for markets, businesses, and citizens alike to the tune of roughly $6 Trillion. Sadly, however, there are those among us that are still struggling to make ends meet. As my colleague at The Driven Fiduciary, James Chapman, recently wrote, the CARES Act offers some relief in the form of access to retirement accounts for those impacted by the virus. You can read the details of what the Act allows for in his post here.

In short, the Act allows for impacted individuals to withdraw up to $100,000 from their retirement accounts in 2020 without the 10% early distribution penalty, for those under age 59.5, and allows the income tax obligations created by the distribution to be split over 3 tax years. It also allows you to pay back the distribution at any time within those 3 years, in effect making the distribution an interest free loan. Further, the limit on the amount that can be borrowed from a 401(k) have been doubled.

These rule changes will certainly act as a much needed lifeline for many Americans in desperate need. For those that are not in dire need for short term funding, however, taking advantage of the ability to access retirement funds without penalty can be expected to have tremendous negative effects on a retirement savings plan. It would amount to shifting a race car into reverse during a race.

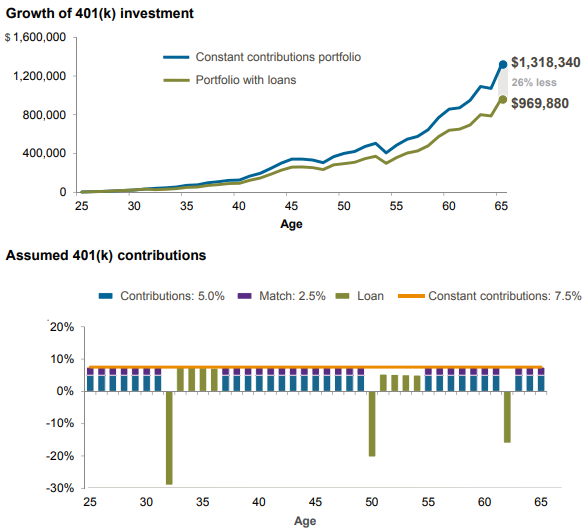

To illustrate this, our friends at JP Morgan Asset Management created a simulation to show the effect of taking loans on a 401(k).

Source: J.P. Morgan Asset Management. For illustrative purposes only. Hypothetical portfolio is assumed to be invested 60% in the S&P 500 and 40% in the Barclays Capital U.S. Aggregate Index from 1979 to 2019. Starting salary of $30,000 increasing by 2.0% each year.

As you can see, taking 2 loans and one distribution (each for $10,000) over the 40 year period resulted in an ending balance that was 26% smaller by retirement, or about $350,000 in this illustration, despite the fact that two of the three were fully paid back. The result would be far more pronounced as the size of the distribution/loan goes up, and if distributions are taken rather than loans that are paid back. This scenario is also assuming a moderate, 60/40 investment strategy. The difference would be even more striking in an environment with higher portfolio returns over the period, such as would be expected with a more growth oriented portfolio or if loans were taken during market downturns before markets were able to recover.

The damage done is from missed market participation while those dollars are out of the market. This is especially true when loans/distributions are taken during times of market weakness, like today, since the assets taken out of the market at distressed prices are not there to participate in the rebound. As the chart below shows, rebounds from bear markets have historically been powerful and fast.

Source: BlackRock. Data from Morningstar as of 12/31/19. Stock market represented by S&P 500. Stocks PR Index. Principal return only, dividends not included. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in the index.

In summary, while these new provisions will act as a much-needed lifeline for those impacted by COVID-19 that are struggling to stay afloat, they will act as an anchor for those that use them unnecessarily. If your goal is to win a race, the first step is to drive forward rather than backward.